Startup Funding Stages

- Nov 27, 2023

- 2 min read

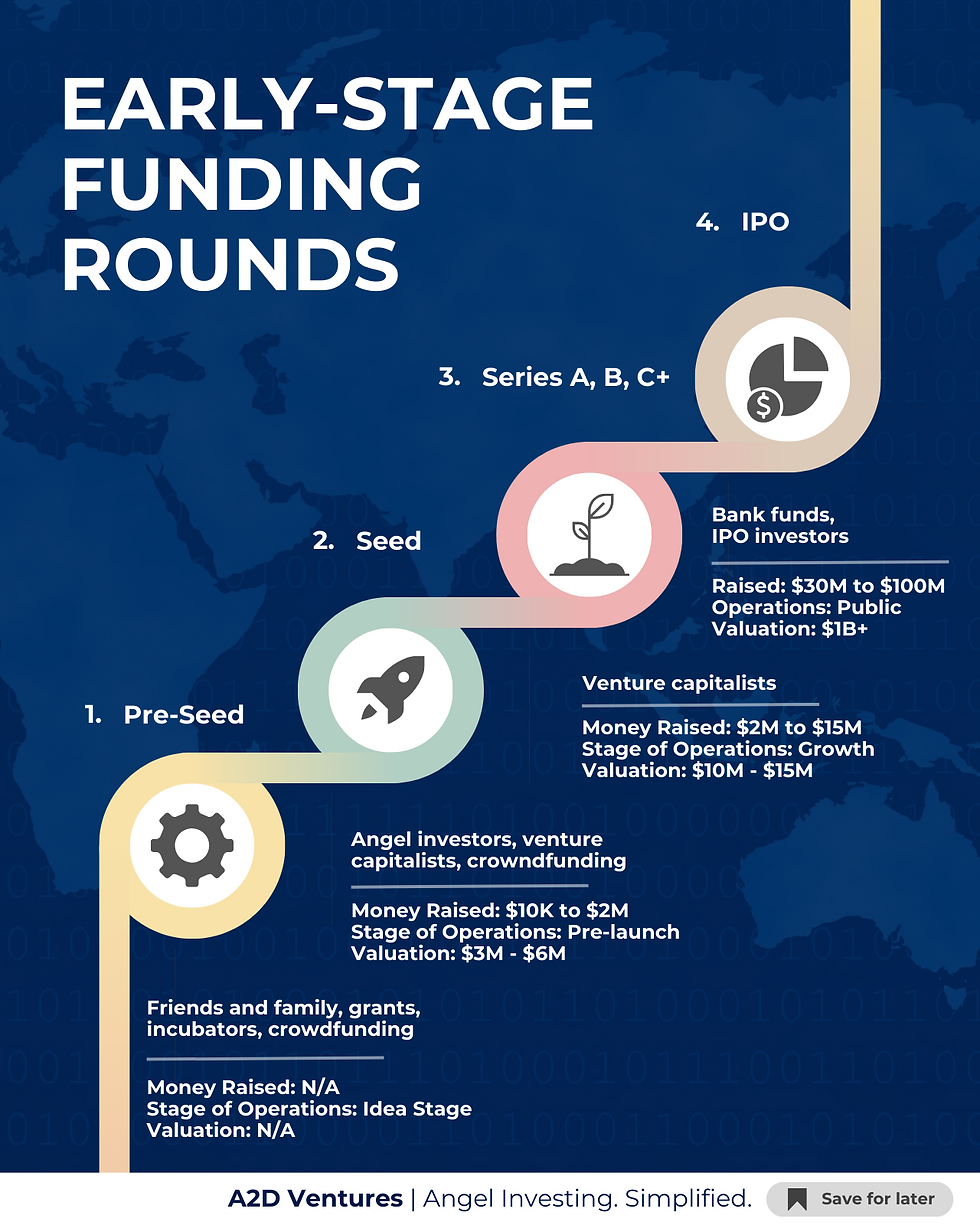

Navigating the exciting journey of a startup involves progressing through distinct funding stages, each with its own set of challenges and milestones. Let's explore the key phases:

1. Pre-Seed Stage:

In the embryonic phase of your startup, it's all about ideation, market validation, and assembling the initial team. At this stage, founders often rely on personal funds, angel investors, or friends and family to kickstart their vision.

2. Seed Stage:

As your concept gains traction, the seed stage is where you plant the foundation for growth. This phase involves securing more substantial funding from angel investors and venture capitalists to develop your product, build your team, and expand your market presence.

3. Series A:

Reaching Series A is a significant milestone. It signifies that your startup has demonstrated market potential and scalability. Venture capitalists at this stage are willing to make larger investments to help you scale operations, enhance product offerings, and solidify your market position.

4. IPO (Initial Public Offering):

Taking a company public through an IPO is a monumental step. It allows your startup to raise capital from the public markets. This stage demands rigorous financial transparency and compliance with regulatory standards. An IPO is a testament to your company's maturity and success.

5. Post-IPO and Beyond:

Post-IPO, your startup enters a new phase of public scrutiny. It's about maintaining growth, satisfying shareholders, and navigating the complexities of being a publicly traded company. Continuous innovation, strategic decision-making, and effective communication become imperative.

Embarking on the startup journey is an exhilarating experience, with each stage offering unique challenges and opportunities. Whether you're securing that initial funding, attracting venture capital, going public, or navigating life as a public company, each phase contributes to the narrative of your startup's success. A2D Ventures' investors syndication is VC-friendly and won't mess with your cap table. Build customer advocacy and raise your brand profile by gaining exposure to hundreds of interested investors. Learn more

Comments